Financial liquidity in the company – how to maintain it?

In previous posts, we described issues related to determining financial liquidity, its ratios, the effects of loss and ways to regain financial liquidity. In the last entry of the series we will suggest how to maintain financial liquidity in the company.

Development of skills of management team - the business training

As you already know, there are various reasons for the loss of liquidity. Undoubtedly, however, one of them may be an inexperienced team that brings the company too few profitable contracts.

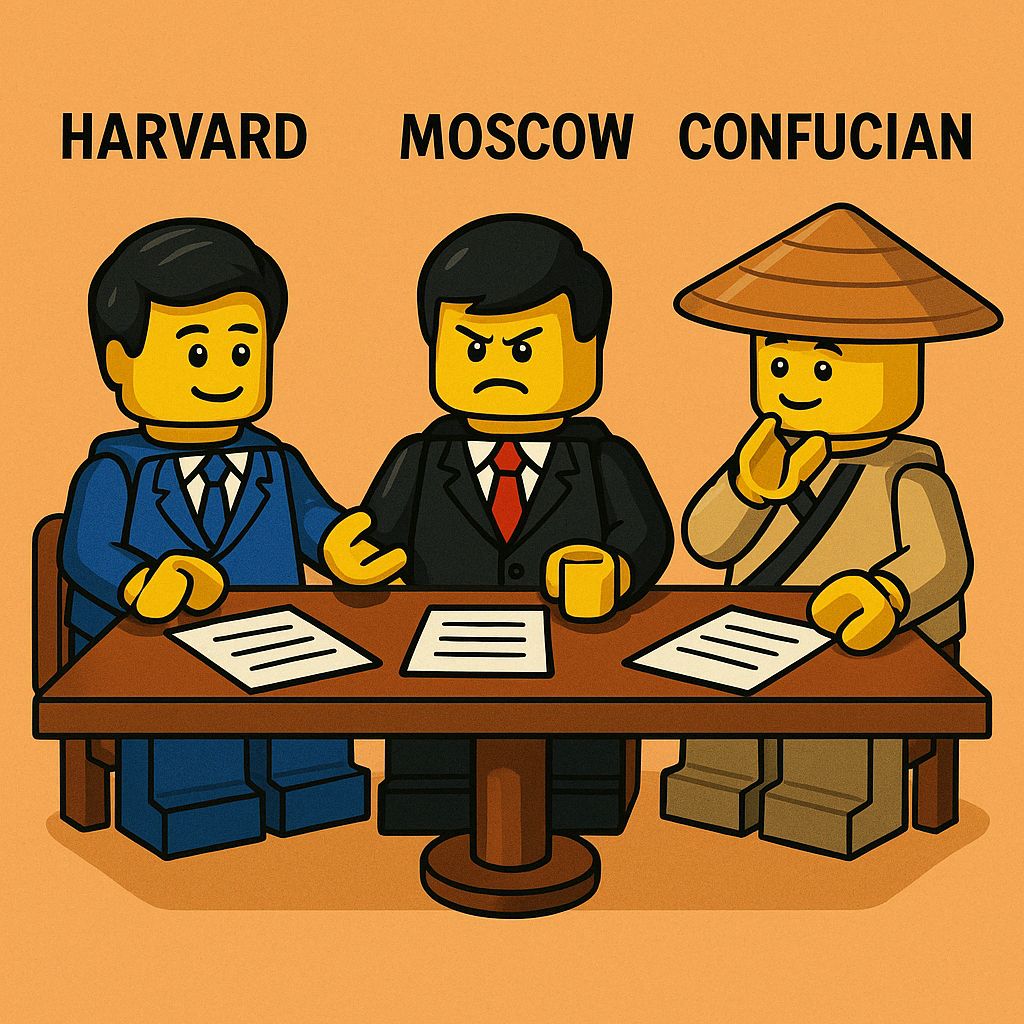

Business negotiations are not easy taks. Good preparation and experience are required to perform them properly. It should also be remembered that the partner on the other side of the negotiating table may have extensive experience and knowledge of how to conduct talks. You cannot allow your negotiators not to have this knowledge.

Even if your team consists of experienced negotiators with many years of experience, this does not mean that they do not need to update their knowledge. Regular expert training is as important as introductory training. You can learn more about the types of negotiation workshops on our blog.

Control is the highest form of trust

Every entrepreneur strives to ensure that his activities bring the greatest profits. However, to avoid losing financial liquidity caused by the insolvency of contractors, they should be constantly monitored. Given the business economic cycles and, for example, seasonality in the industry, it is not a foregone conclusion that a company with an established market position will not be in financial trouble. When running an enterprise, it is important to monitor investments made and contracts concluded.

When signing a new contract or negotiating its terms, make sure that you are talking to a person who has the authority to take financial obligations and represent the interests of the other party.

If you want to master your knowledge about negotiating contract terms, use professional business consulting and business trainings.

Diversification of revenue sources

Finally, avoid becoming dependent on one or two contractors. Diversify your sources of revenue so that one customer does not constitute more than 25% of your company's turnover. In a situation where one contractor stops paying its obligations on time, it will not have a devastating effect on your company's financial liquidity. Concluding contracts with various contractors has other advantages, such as increasing the competitive advantage.