Author:

Automotive forecasts. Is the situation in the automotive industry going for the better?

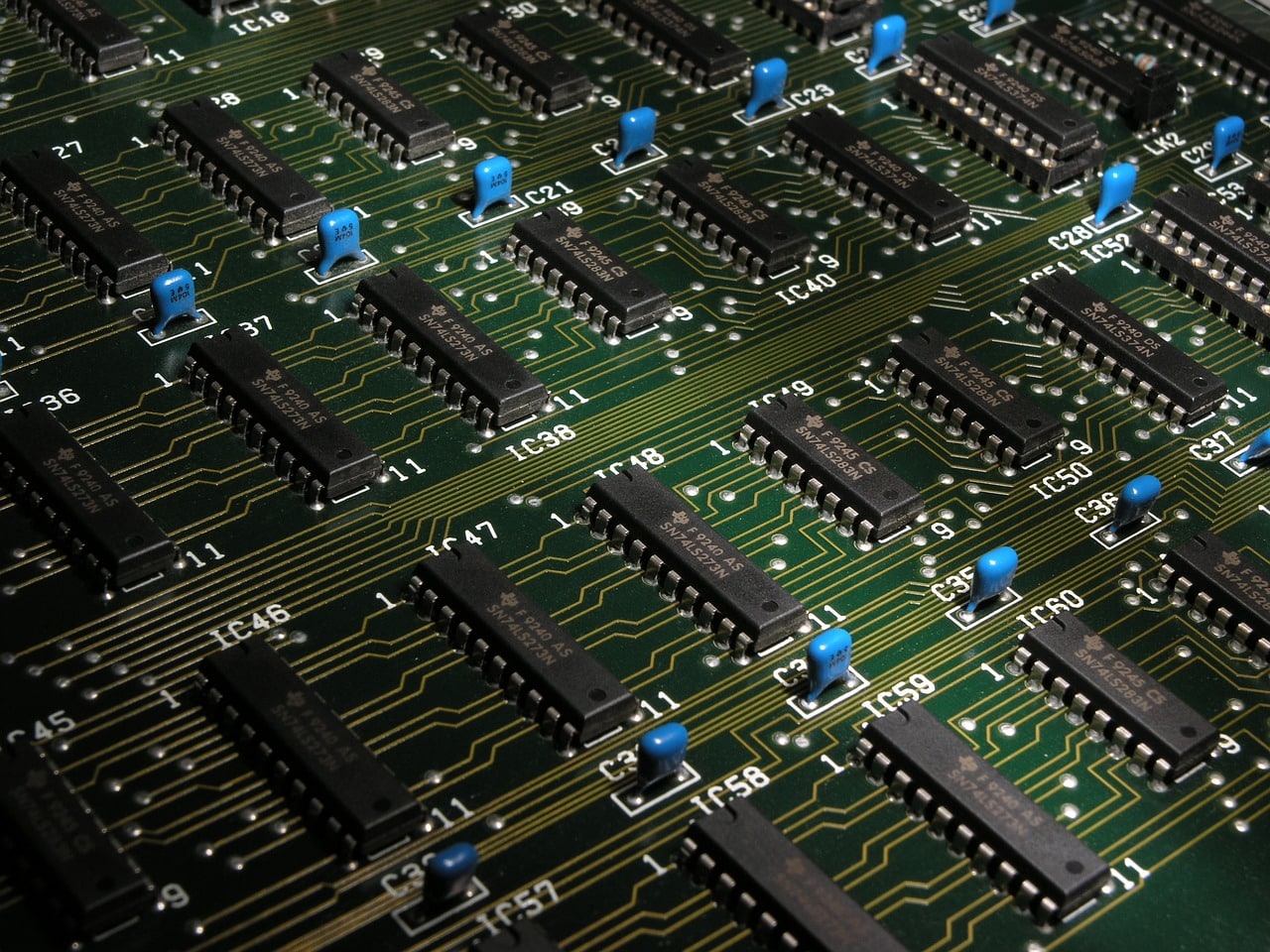

On January 14, 2022, Eveneum and Santander Bank Polska co-organized an online seminar "Disruptions in supply chains - forecasts for the automotive industry in 2022". In the first part of the meeting, Radosław Pelc - Automotive and TSL Analyst Santander Bank Polska and Rafał Dados - Managing Partner of Eveneum shared with participants market data regarding, among others: car sales volume, consumers sentiment to buy a vehicle, dealers’ inventory, threats to commodity markets, new investments in semiconductor production capacity.

The main point of the online seminar program was a discussion in an expert panel, which was attended by:

- Krzysztof Wesołowski - Purchasing Director, Bury

- Mateusz Rak- Global Purchasing Director, Varroc Lighting Systems

- Paweł Iracki - Sales Director, FŁT Kraśnik

- Sławomir Welezinski - Regional Director Aftermarket in Eastern Europe ,Delphi Technologies

Summarizing the data initially presented, Mateusz Rak confirmed the prominent level of orders from OEM. At the same time, he added that the situation was still difficult in terms of supply chain. He stressed that the level of allocation from chip manufacturers is still between 60% and 70%. Any improvement in the situation will take place only when the production base increases. Mateusz also drew attention to force majeure events harassing the industry, e.g. the coronavirus pandemic, long winter in the US, and recent floods in Malaysia and Taiwan. The flooding resulted in a recent two-week shutdown of a quartz producer. Further discussion was devoted to electronics. Krzysztof Wesołowski drew attention to the benefits of multisourcing. However, he stressed that with the current market situation it is difficult to execute supplemental, urgent orders from clients. In his first speech, he summarized the situation on the semiconductor market as follows:

"... the crisis has been going on for so long that we have learned to live with it, and it is not such a shock for us anymore."

Considering the forecasts for the automotive industry, our experts emphasized that the purchasing strategies (supply chain management) of car manufacturers (OEM) and for the first line suppliers (Tier 1) must be changed to adapt to the new reality. Krzysztof emphasized that financial risks in the entire supply chain depend primarily on OEMs. Krzysztof noted that the financial reports of car manufacturers look solid, as well as the record result of semiconductor manufacturers. Semiconductor manufacturers are requesting orders one year ahead, non-cancellable, non-transferable, including a declaration that customers will cllect anyway the contracted quantities, even if the price changes from originally contracted. The failure of major market actors to act proactively to rectify the situation creates frustration for first- and second-tier suppliers.

Which OEMs stand out for their proactive attitude in the fight against the crisis?

Mateusz Rak and Krzysztof Wesołowski especially honored the proactive actions of the BMW. The brand is active in the field of contracts and vertical security throughout the supply chain: manufacturers for the first build, manufacturers of second line (e.g. PCBs), third line (components), fourth line (e.g., quartz). For example, at the end of last year, BMW signed a contract with Inova Semiconductors and GlobalFoundries. We are talking about amazing integration, contracting to ensure the availability of components. The second OEM listed and complemented was Tesla, dubbed "computer on wheels", which has strong relationships with electronics manufacturers.

What is the situation in other markets than electronics?

Later in the meeting, the discussion focused on threats in supply chains other than electronics. Paweł Iracki spoke about the difficulties in the availability of steel (especially flat products), polymers, cardboard, wooden pallets, stretching from the spring of 2021. The company clearly felt an increase in costs with each month of 2021, and thus a decrease in the profitability. Focusing on steel, Paweł gave an example of specific grades used in the production of bearings.

Quotas are introduced for steel imported from outside Europe, quantified for each quarter of the year. As of January 11, 2022, the quarterly quota is already 30% utilized for the steel that his company needs for production. This shows that the problems will continue this year.

An additional factor influencing the operating costs in 2022 will be energy and gas prices, which are a challenge for the whole of Europe. Paweł shared an example from a partner from Slovakia. In the earlier energy supply contract, the supplier had a price of EUR 30 per MWh. Currently, it is up to EUR 300 per MWh. Forge shops that must heat the material with electricity have even put on hold their production. This can make it even more difficult to buy materials and components in the market.

Sławomir Weleziński, looking at the forecasts for the automotive industry, focused on the situation in the spare parts market. He confirmed Paweł's words about the demanding situation in the steel products market. To illustrate the situation, he gave an example of the final product, which is a brake disc. Most of the market is supplied by manufacturers originated from China. In approximately 15 months, the cost of the brake disc increased by 30% -35%. This was due to three factors: raw materials, logistics and limitations in the supply of electricity to Chinese factories. In 2020, the increase in manufacturers prices was gradual, but in 2021 it was a sudden shift - double-digit! For example, last year, just before Christmas, a brake disc supplier announced that the delivery was ready for pickup, but subject to approval of an increase of X percent in price. The vendor said that if they cannot accept this increase without negotiation, then "he understands it and he will sell the goods to someone else." Delphi has launched a new factory recently, but the start of production is hampered by challenges in global supply chains.

Can shortages affect the innovativeness of the industry and changes in the structure of demand?

Mateusz Rak shared two examples. One customer is extending the life cycle of one of the products (cars) by delaying the introduction of a new model. Another customer returns to a less technologically advanced solution. Due to the lack of availability of diodes (led), it returns to light bulbs.

Until recently, it seemed impossible, because the market of incandescent lamps was shrinking by 20% -30% annually.

Customers also choose solutions, e.g. without a rear-view camera. It is a step back when it comes to product innovation - concluded Mateusz. Companies running in the spare parts segment (aftermarket) benefit from the current situation. Sławomir Weleziński noticed that fleet customers stay with their current cars and extend lease agreements. The result is additional service activities that fuel the business. Paweł Iracki gave the example of his business partners who ordered trucks before Christmas 2021 and received confirmation of the order for 2023. Summing up, the participants said that supply is and will be a brake factor to stabilize the situation in the coming months. The perspective of the automotive industry is still unfavourable.

Entire meeting video recording (available only in Polish language)

Rafał Dados

18+ years of experience in project sourcing and strategic procurement. Managing Partner at Eveneum, a company specialized in advisory and competencies development. Focused on sectors where relationship building and trust element between partners is the mission critical factor. Supports customers on early suppliers engagement processes and early procurement engagement into R+D work. He has been delivering projects related to: negotiations on behalf, niche technology suppliers scouting. Keynote speaker at Polish and international conferences. Lecturer at Jagiellonian University (Procurement Management post graduate studies).