Author:

On October 14, 2022, Eveneum and Santander Bank Polska co-organized a webinar entitled "How automotive sector strive with inflation?".

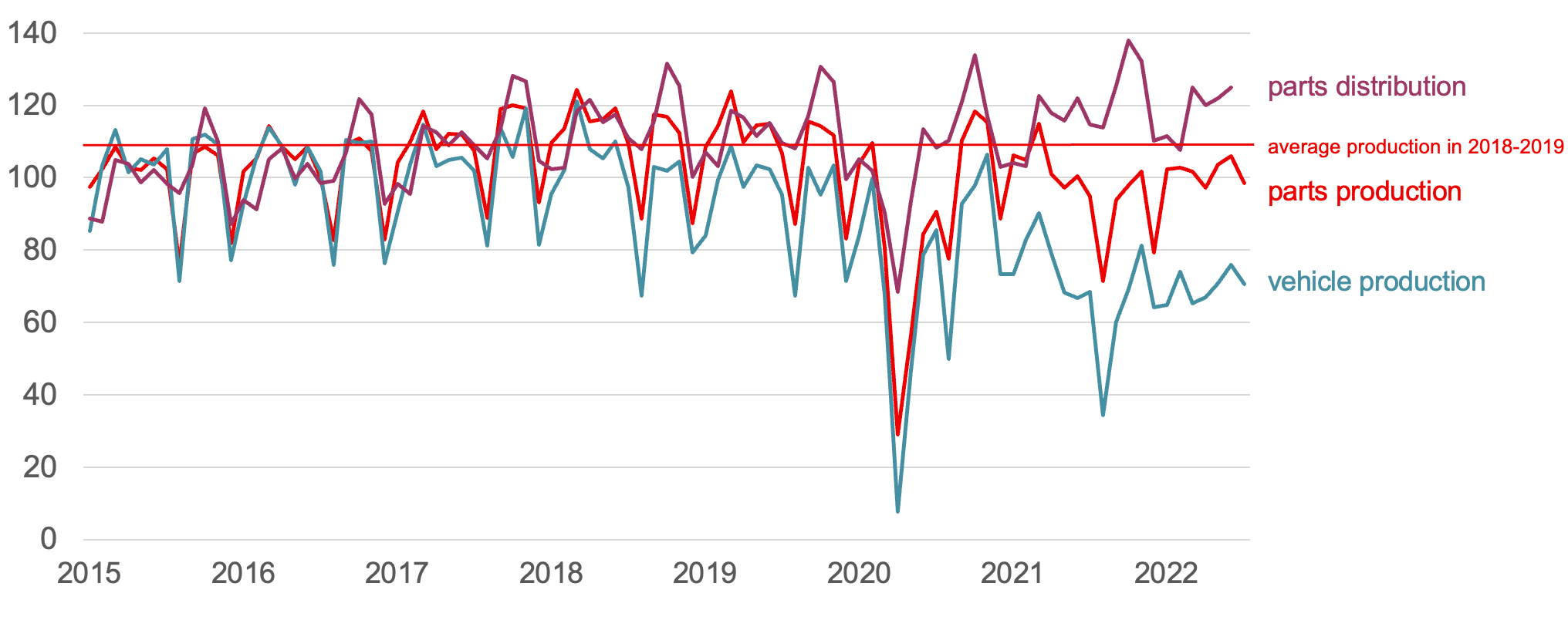

The meeting was opened by Rafał Dados - Eveneum's managing partner by presenting the agenda of the meeting, then Radosław Pelc - an analyst of the automotive and TSL sectors of Santander Bank Polska presented the participants with the latest market data on, among others: operating profitability of parts manufacturers, volume in the automotive industry, imports of car parts, production prices /distribution of parts, costs of parts manufacturers, demand in the part manufacturers sector, consumer willingness to purchase cars.

The central point of the webinar was a discussion in the expert panel, attended by:

- Mateusz Rak - Global Purchasing Director, Plastic Omnium

- Sławomir Weleziński – Regional Director Aftermarket in Eastern Europe, Delphi Technologies

Mateusz Rak referred to the previously presented data, noting a new approach of some customers to the challenging reality. He highlighted careful planing of operations of car manufacturing companies [OEMs]. As an example, he cited the actions of Ford, which, based on its consumer demand data, maximized the supply of parts for the production of models with a high sales index, while minimizing the supply of parts for models with low interest. Mateusz also referred to the first question posed in the discussion, namely - "Are there concerns about the decline in demand on the part of OEMs?". Citing the data, he said that at the moment, no drop in demand is expected. Orders for parts are so high that car manufacturers may catch up in car sales in the near future.

Sławomir Waleziński noticed the continuous dependence of suppliers on access to semiconductors and electronic components. He summed it up with a statement.

“…it is actually Tier 2 & 3 suppliers who limit OEM and Tier 1 production.”

Sławomir said that producers are more willing to invest in newer technologies. In the era of the electrification trend, these models are gaining more attention and additional volumes allocation.

Do OEMs develop only those models that they consider attractive or also those that are unattractive to them, e.g. cars with a traditional drive?

We see the extension of contracts for existing carlines and the lack of investment in the new versions of traditional technologies. Withdrawal of certain versions of equipment - an example for discussion was the Ford brand, which in some cars decided to put on hold versions with reverse cameras and LED lighting, putting on only light bulbs in some lighting elements (technologies which market was declining by 30-40% annually over last years). The panellists agreed that this situation suits car manufacturers as they can steer the production structure and focus on higher margin products.

What is the burning problem of the industry - rising purchase prices or unavailability of components?

According to Sławomir Weleziński, both factors are a big challenge. The reduced availability of the components forces buyers and logistic departments to be more creative in reaching out for supply. The increase in the costs depends on three important parameters: energy, inflation and exchange rate. The listed parameters can also be viewed through the prism of the supplier country of origin, its policy and currency.

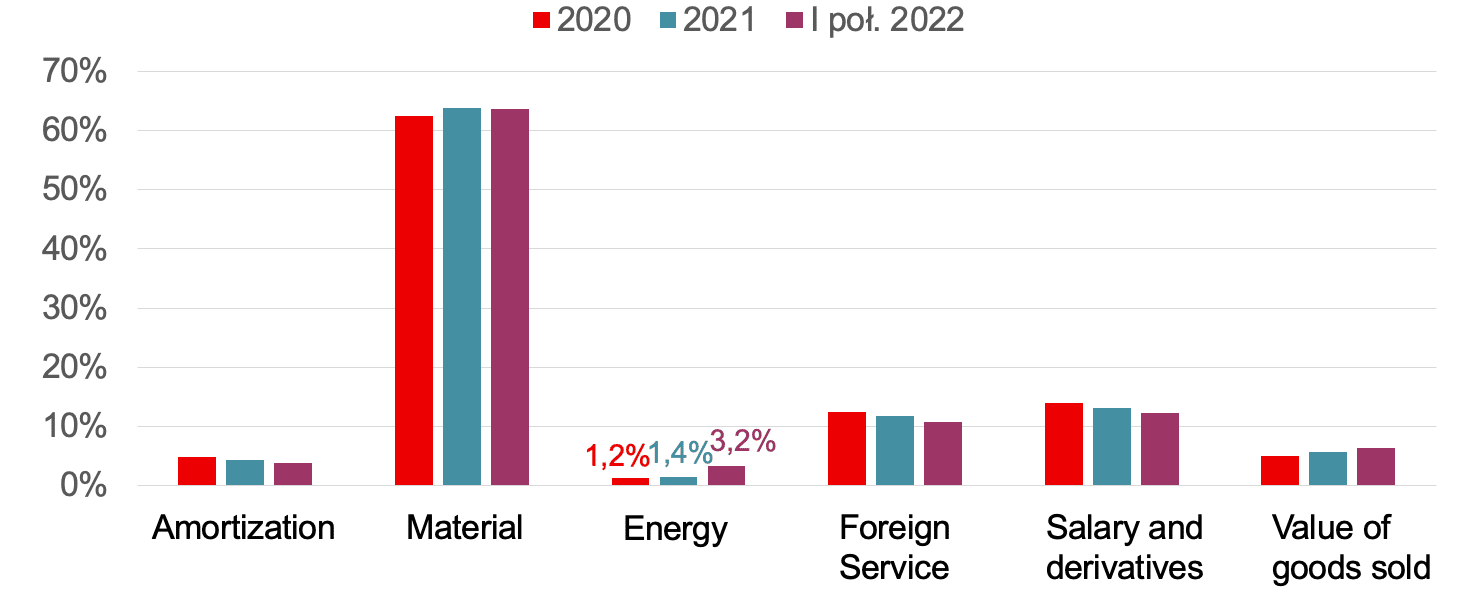

The structure of operating costs of automotive parts manufacturers in Poland

To what extent can fast-growing costs be passed on to customers?

To what extent can fast-growing costs be passed on to customers? Sławomir and Mateusz answer unanimously - it is very difficult, but we meet with more and more understanding. “This is the trend of the whole value chain, and the most severe situation is for Tier-1. Talk make progress on electricity, partly FX (depreciation of EUR vs. USD/CNY), however inflation as stand alone factor is excluded from the negotiations. For raw materials the problem is additionally complicated by the crossover between the so-called split (i.e. percentage coverage of exchange rate fluctuations) and the subject of escalation - net/gross weight, e.g. production by machining may mean a loss of material of even 10-15%, the contract is for net weight, and Tier-2 suppliers in most cases are paid for gross – weight * scrap price”.

To what extent does the good financial condition of OEMs make them accept price increases?

Referring to OEM's good financial reports for the past year is not a valid argument in negotiations. Companies believe that these results are the result of their well thought actions in the market. Acceptance of component price increases is conditional, temporary and often dependent on the acceptance of volumes higher than those that can be covered by suppliers.

Changes in the way suppliers operate and negotiate with them. Has the short-term relationship with suppliers changed? Is the share of deliveries from Asia (mainly China) changing?

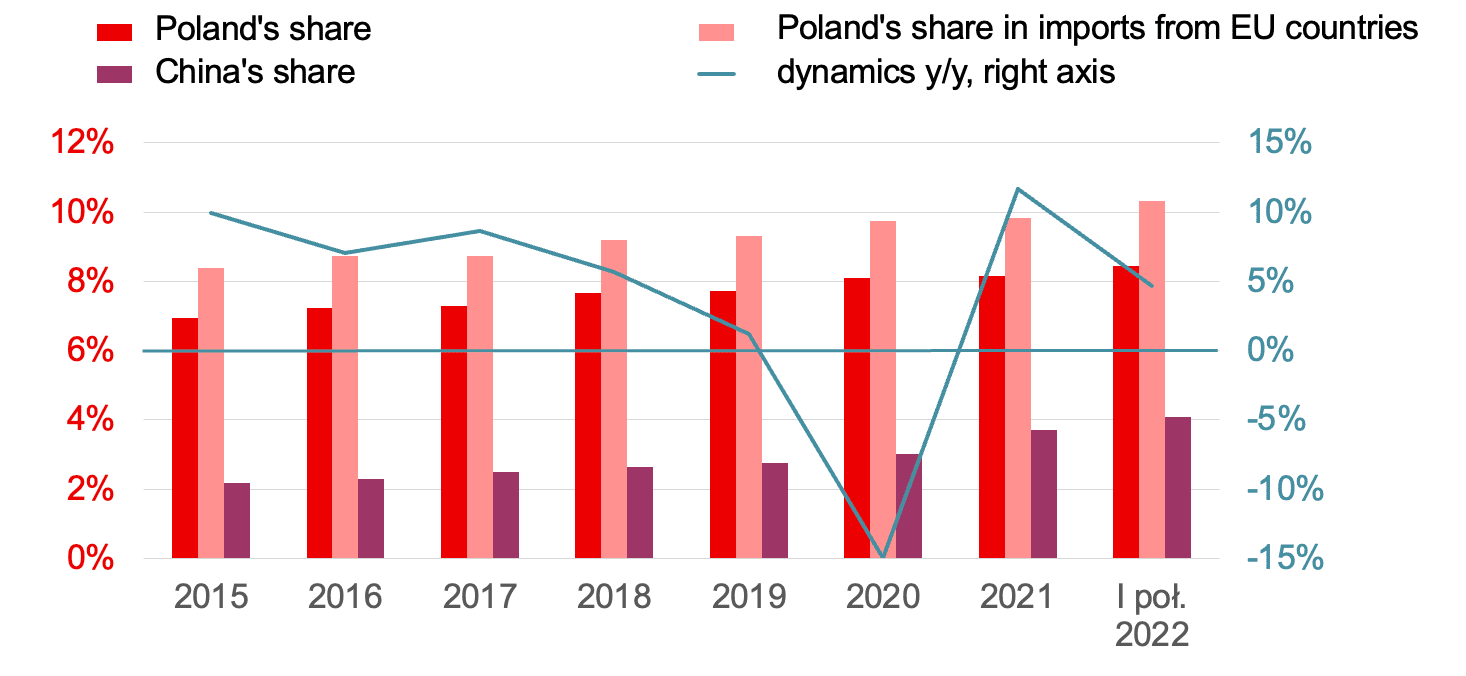

Imports of parts by EU countries (value in EUR)

Talks about price increases are not easy, but the length of the relationship and cost transparency with the supplier help here. In times of crisis, we are strengthening our relations with suppliers with whom we did not have them before, today there is simply no way out.

The data presented at the beginning shows that in recent years the share of imports from China has been growing relatively. Sławomir talked about the opposite situation from the perspective of the aftermarket. The share of Chinese suppliers in the aftermarket is still high, but the level of trust has decreased, the search for new, alternative suppliers has begun.

Can we be asked about NATO membership of our supply chain during the audit? Do OEMs require the supply chain to be located in the appropriate economic area?

From the point of view of Delphi Technologies - we require our suppliers to place the supply chain in the appropriate economic area. American companies take a fairly unilateral approach to sanctions. As far as car manufacturers are concerned, we have not encountered such requirements - Slawomir Weleziński.

What are the financial forecasts for component manufacturers?

"Taking into account all segments, i.e. traditional technologies, new technologies and the secondary market, it should be stable, but without spectacular growth." Slawomir Welezinski

“Without help and understanding from automakers, what we saw in 2008 would happen – a wave of consolidations and acquisitions. Regardless of what happens to the availability of components, which, as we know, will not improve until the end of 2024, and future unforeseen disruptions in the supply chain, car prices will increase. If manufacturers are able to share component price increases, we may be able to avoid the wave of bankruptcies that is imminent.” Mateusz Rak

Rafał Dados

18+ years of experience in project sourcing and strategic procurement. Managing Partner at Eveneum, a company specialized in advisory and competencies development. Focused on sectors where relationship building and trust element between partners is the mission critical factor. Supports customers on early suppliers engagement processes and early procurement engagement into R+D work. He has been delivering projects related to: negotiations on behalf, niche technology suppliers scouting. Keynote speaker at Polish and international conferences. Lecturer at Jagiellonian University (Procurement Management post graduate studies).