Author:

How war in Ukraine and sanctions on Russia may impact short and mid term sustainability of global supply chains. Status as on 21st of March 2022. Part 2.

We hosted online purchasing community meeting on 18th of March 2022. 60+ experts joined to get insights and to discuss about consequences to global supply chains sustainability of Russian invasion on Ukraine. The ongoing war in Ukraine resulted in sudden interruption of manufacturing activities in Ukraine. Sanctions on Russia imposed by law and additional volunteer cease of operations in Russia resulted in harsh disturbances in logistic flows worldwide. In our meeting we decided to focus on the following industries and resources:

- automotive

- steel

- nickel

- aluminum

This is part two of the webinar abstract. It pertains raw material markets.

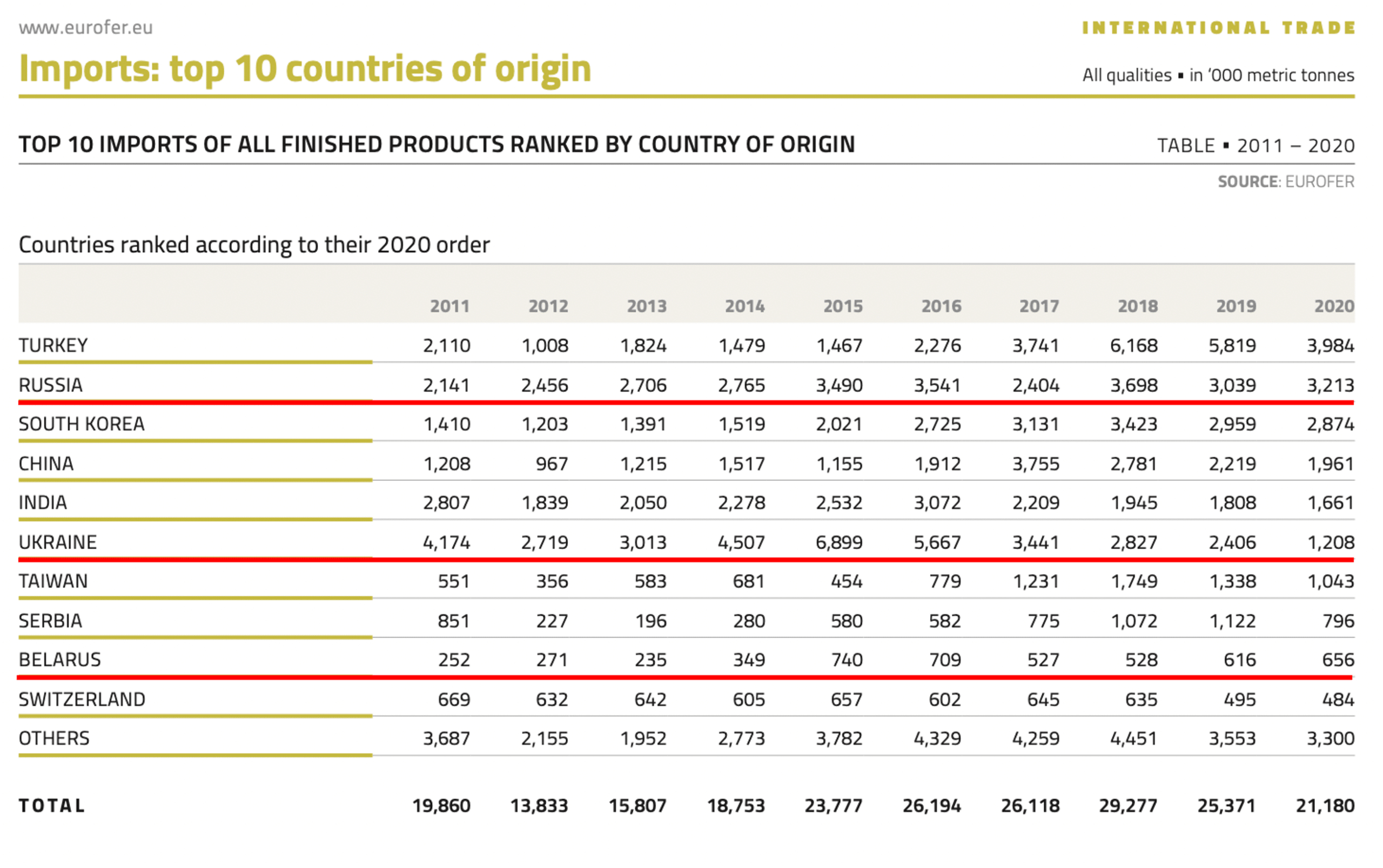

How is the steel supply to EU impacted?

European Union in the 4th package of sanctions imposed on Russia included steel products. The import ban on Russian and Belarus steel includes a three-month transition period to wind down existing contracts. During this time, any material bought in affected countries under contracts established prior to the cut-off dates:

- 2nd of March 2022 on Belarusian origin

- 16th of March 2022 on Russian origin

including ancillary contracts will be allowed to enter the EU. There will be no longer an import quota specifically assigned to Russia and Belarus. These products will need to be imported under the (proportionally increased) residual quotas for the respective product categories, which also allow for duty free import. The decision to block import steel products is worth approx. €3.3 billion. More details can be found under this European Commission news page.

What does it mean to the market?

Remark: this article was written prior to information on Azovstal (Mariupol, Ukraine) bombardment by Russian military forces. Video with CEO of Azovstal, Mr. Enver Tskitishvili, commenting the situation and steel mill preparation to war time can be found under this link.

To some extend market in EU perceived Ukrainian steel origin supply as too risky what is seen in above chart. In 2014 Russia invaded Crimea and Donetsk regions and as the situation was unsettled for months and years, the import from Ukraine has been decreasing constantly. Russian and Belarusian import quotas will be distributed among other EU partners proportionally. The entire value chain has three months starting from above mentioned cut-off dates to adjust value streams. Even, simply due to logistic distance, especially for CEE consumers it means higher prices of steel products. Meanwhile the speculation activities in the market exploded. Some market actors (makers and distributors) have undertaken attempts to withhold sales to put pressure on the prices. In general there should be enough of steel in the market. Customers who builded up safety stocks can wait and observe the market speculation is over.

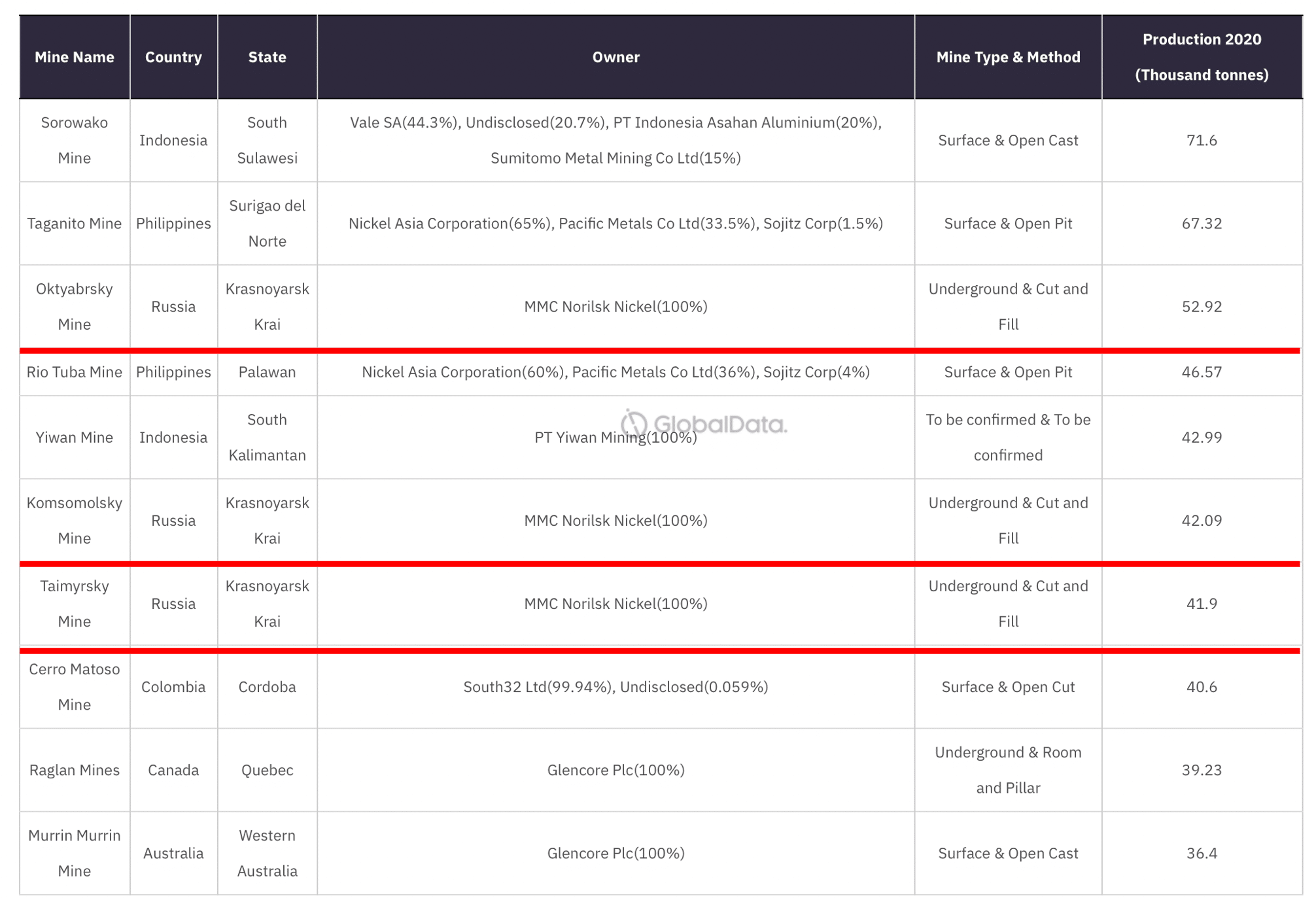

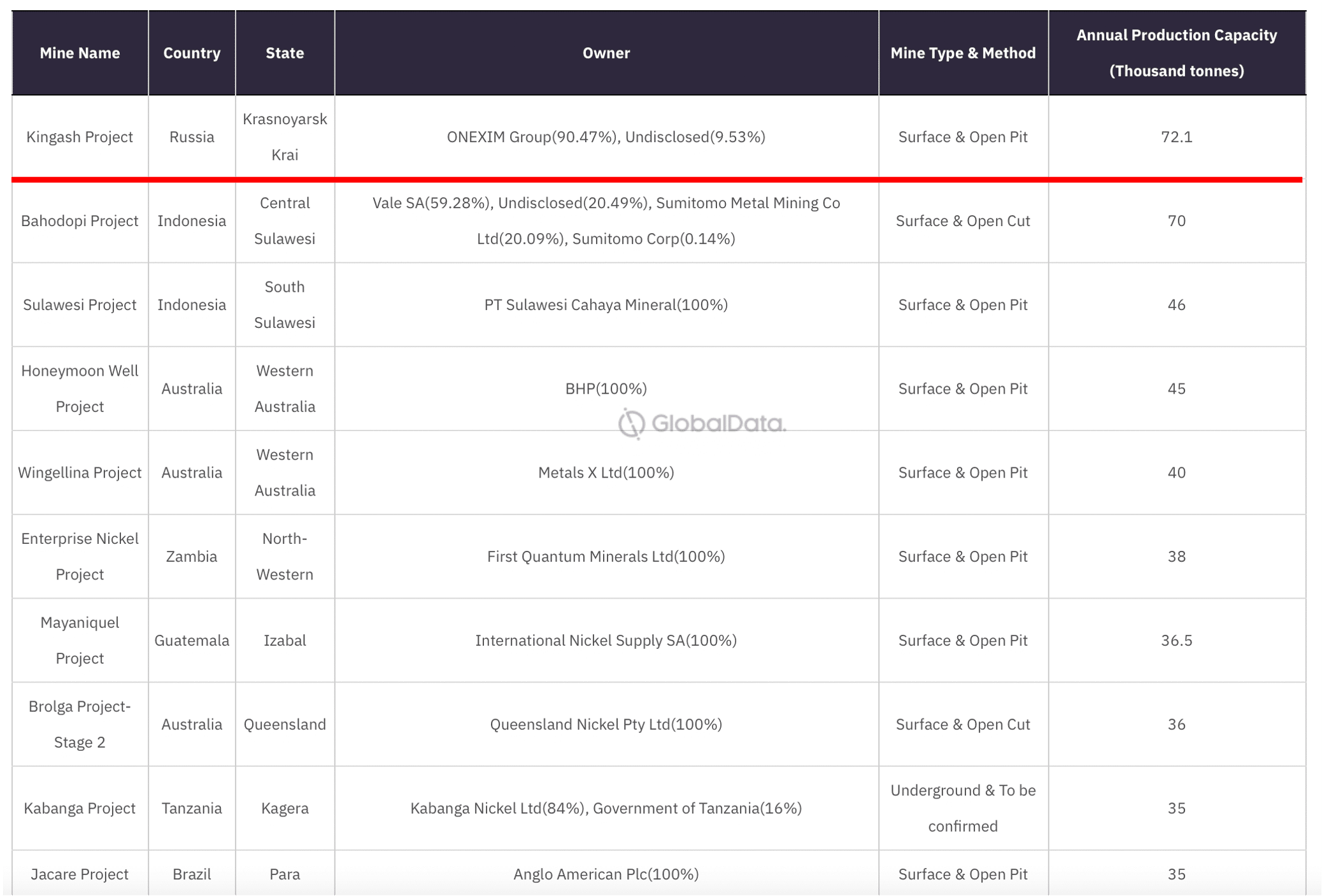

How is the nickel and nickel related supply to EU impacted?

Global consumption of nickel is in 70% linked to stainless steel production. However there is underdog market yet that is heavily dependent on future availability and cost of this element. It is EV batteries market. Nickel is a part of cathode in the battery and enables high energy density batteries production, what translate into long range of electric cars. Just to note that the range is one of two main roadblocks to quickly popularize EV green transformation. As of today only 10% of global nickel consumption is by EV batteries, however it is foreseen to be even 30% by 2025.

Currently Indonesia is the biggest source of nickel, followed by Philippines. Russian Federation is number three globally. The sector needs in the following years investments in production of so called high purity class 1 nickel. Only such grade can be used in production of EV batteries. Although today global supply chains are exposed on shocks related to Russian origin of nickel and potential ban on import from this origin by leading EV batteries manufacturers, long term there is enough of globally dispersed sources.

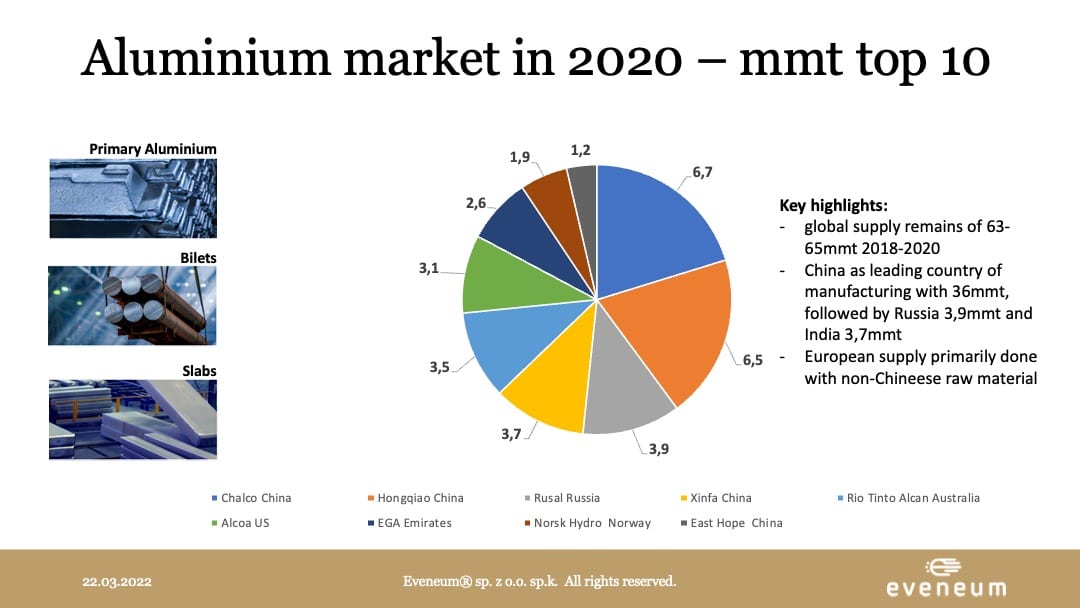

How is the aluminum supply to EU impacted?

Aluminum market could be one of the most impacted due to war in Ukraine and sanctions on Russia. There are several makers in China (East Hope, Xinfa, Hongqiao, Chalco) with substantial share in the global output. On top of that China is heavy consumer of aluminum, hence big chunk of production will be consumed in domestic market. Rusal from Russia in 2020 provided annual output of 3,9 mmt. Recently Australia banned the export of aluminum ores to Russia, which relies in 20% on Australian supply. Aluminum is an important metal that plays a key role in the Russian military production. Long term buyers in aluminum market will be challenged both by price and availability.

Is your supply chain suffering from lack of components from Russia or Ukraine?

Our consultants have vast experience in automotive and raw materials sector, being responsible for supply base development in Central and Eastern Europe for years. We provide service to our Customers in terms of suppliers identification, audit and recommendation. Longterm we support the relationship between supplier and customer, making sure that potential risks are mitigated and that both sides benefit from the cooperation. If you need help on seeking new suppliers feel free to book consultation with us.

The first part of the article focused on automotive under link.

5 minutes abstract from the meeting. Contact us if you need 60 minutes long recording of entire event.

Rafał Dados

18+ years of experience in project sourcing and strategic procurement. Managing Partner at Eveneum, a company specialized in advisory and competencies development. Focused on sectors where relationship building and trust element between partners is the mission critical factor. Supports customers on early suppliers engagement processes and early procurement engagement into R+D work. He has been delivering projects related to: negotiations on behalf, niche technology suppliers scouting. Keynote speaker at Polish and international conferences. Lecturer at Jagiellonian University (Procurement Management post graduate studies).

Mateusz Rak

Global purchasing director, expert in global function transformation

15+ years of experience in: setting-up and developing shared service centres, developing and transforming effective purchasing teams, strategic procurement and commodity management. Participants of the Negotiation and Mediation Tournament for Business Professionals had an opportunity to meet him as he was a member of the jury team. He has worked for ABB, Alstom, International Airlines Group, Rolls-Royce, Valeo and Varroc Lighting Systems. Mateusz is ready to support our Clients from railway, aerospace and industrial automation sectors. He is subject matter expert at: strategic procurement management, function transformation and category management.